The BEST Loan Options for Medical Practices

webmanager • May 17th, 2023

Starting a medical practice can be stressful.

And like any business, figuring out where, and how, to get the capital you need to keep going can be the most stressful part.

Especially so in the medical field when you have thousands of dollars in student loans hanging over your shoulder.

The good news is that there are several great options when it comes to funding your medical practice.

In today’s blog, we’re going to cover the best loan options for your medical practice and point you in the right direction to get started.

Let’s dive in.

First things first, what is a medical practice loan?

A medical practice loan provides necessary funding for new and existing medical service businesses.

The qualifications for medical practice loans are typically based on the health of the medical practice,

as well as the individual professional’s credit worthiness.

However, there are loans specially geared towards doctors and dentists that take into consideration unique circumstances, such as thousands of dollars accumulated in debt.

When it comes to the type of medical practice loan you should take out – there are several great options to choose from.

Here are a few of the ones to consider:

When it comes to the best loan options for medical practices, there are two we recommend the most.

However, it’s important to note that the best loan option for your medical practice will always depend on your unique situation.

We recommend getting in touch with an experienced medical accountant to help you weigh your options and choose the most advantageous option.

This is an important decision, and it’s always best to bring in a knowledgeable expert.

The first loan type we recommend for doctors and dentists is a Small Business Administration, or SBA loan.

An SBA loan is a great option for doctors and dentists because of its flexibility and terms. SBA loans carry some of the lowest interest rates and longest repayment terms on the market.

Additionally, due to the financial security of being a doctor or dentist – higher wages, high credit scores, and steady income – both professions are typically strong candidates for this competitive loan.

However, if you’re just starting your practice for the first time, an SBA 7(a) loan might not be the best option. The most qualified borrowers not only have strong credit scores, but also a few years of experience in business under their belt, too.

The next loan option for medical practices we recommend is a business line of credit.

A business line of credit operates differently to the typical bank loan you’re used to. In fact, it operates more like a business credit card.

A lender will approve you for a set amount, and you’re able to quickly access the funds when and where you need it.

It’s essentially a safety net to have in your back pocket for fluctuating expenses or big equipment purchases.

Given its flexibility and cost-effectiveness, the business line of credit is widely considered among the best medical practice loans for doctors and specialists—regardless of what stage of the business you’re in.

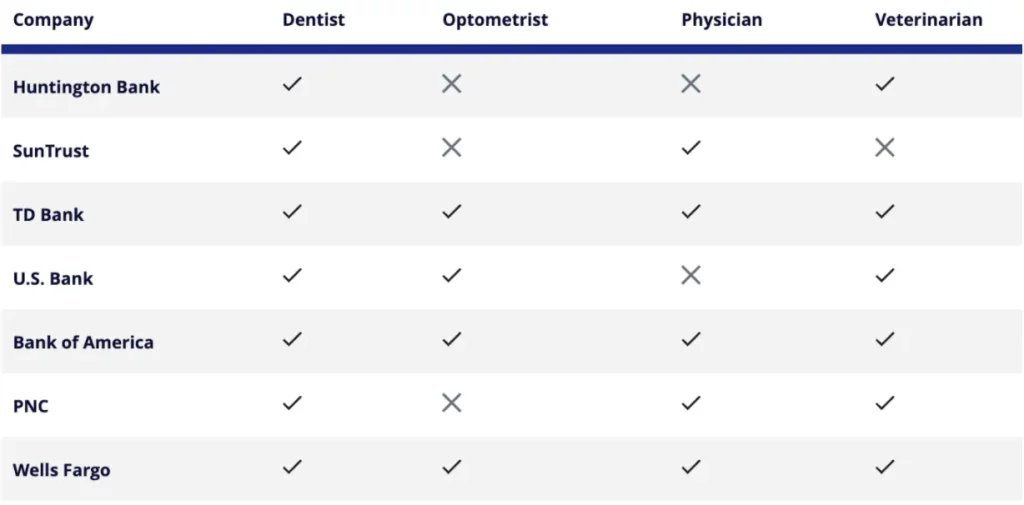

To keep things simple, here’s a quick list of banks to look into for your medical practice loan:

Chart Credit: Business.org

The #1 thing we recommend doing before borrowing money for your medical practice is to consult with your medical accountant.

An experienced medical practice can help you weigh the pros and cons of taking out a business loan, and help you choose the most economic option for your situation.

If you don’t currently have a dedicated medical accountant, you can book a free consultation with one of our accountants any time. We’re always here to help.

Samy Basta brings you more than 20 years experience in tax, financial, and business consulting to his role as founder of Basta & Company. His focus is primarily strategic business planning, empowering clients to set priorities, focus energy and resources, and strengthen operations. In addition, Samy and his firm provide strategic counsel, and technical insight, on a wide range of needs, including tax saving strategies, tax return compliance, as well as choice of entity.