Startup Equity Explained!

webmanager • May 17th, 2023

If you clicked on this article, then congratulations!

You are either starting a business, or joining a startup, and either way you’re in for an awesome ride.

Startup equity is a great way to compensate investors and employees for helping you grow your business from the ground up.

In this blog, we’re going to walk you through exactly what startup equity is, the different types of startup equity, and how you can distribute it as an owner of a company.

Let’s jump in!

First things first, let’s talk about what startup equity is.

Startup equity describes ownership of a company.

Depending on the type of company that you are starting or joining, the definition can vary.

You’ve probably heard about startup equity for employees.

Many companies use startup equity to compensate and incentivize existing employees, and attract potential employees.

The amount of startup equity given to an employee can range from 0% to 6%, depending on the role they play, level of commitment, and innovation opportunity they bring to the table.

As a startup founder, you should prepare to give away equity to investors in exchange for cash as a way to compensate them for risk. This conversation should take place while you’re pitching your idea and negotiating investments, so it’s a good idea to speak with a qualified startup accountant beforehand.

One thing you might not know about startup equity is that equity is usually vested over a 4-year period.

Therefore, you usually receive nothing in the first year.

The tax implications of startup equity can get complicated, so we strongly recommend chatting with a startup accountant before receiving or giving equity as compensation.

You can also read our insightful blog post about that here.

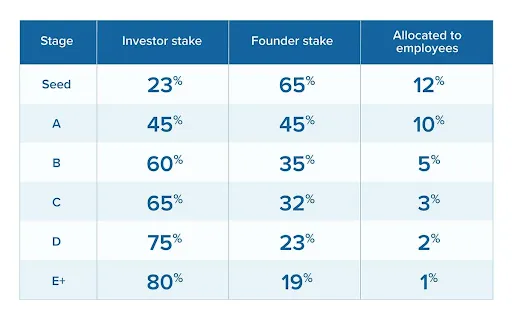

There is no exact or perfect formula, as the allocation is dictated by various factors, including timing, business model, industry, and the number of stakeholders involved.

Here’s how equity distribution often progresses, as the startup grows and moves through different stages:

Here are a few things to consider when allocating the equity:

Not all equity is created equal.

There are different types of equity, and they all come with different preferences, prices, and tax consequences.

For example, investors usually receive preferred stock, advisors typically get advisory shares, and employees usually receive stock options.

Each type of startup equity has different timelines for receiving shares, and may be paid out differently if the startup gets acquired in future.

SAFE Stands for Simple Agreement for Future Equity.

It’s an instrument that allows investors to give you money now, in exchange for a promise from your company to receive shares at a future date when your company raises capital on a price round.

This tends to be a company-friendly way of raising capital and can be a good option to fund your startup.

It’s important to note that SAFE is not a convertible debt.

A debt instrument has an interest rate attached to it, and a maturity date for when the debt should be paid by.

A CAP table is not a table full of caps… it’s simply the equity capitalization of the company.

It tells you who owns the company at any point in time, including founders, investors, and employees.

You don’t see only who has ownership today, but also who has the right of future ownership, which ultimately could include stop options, stock warrants, and a few other securities as well.

Most VC-backed startups give employees stock options, which is called the option pool.

Why?

It’s a great way to recruit talent because when employees receive options in the company, they are more likely to work hard and make the company successful, as well as stay in the company longer.

At Basta & Company, we’re here to help. We’re experienced tech accountants who work with tech & startup companies day in and day out to help make startups more profitable, and carry a lower tax burden.

If you are in need of a better startup accountant, or simply just want to ask a question, you can book a free 15-minute chat using our online calendar here.

Until next time!

Samy Basta brings you more than 20 years experience in tax, financial, and business consulting to his role as founder of Basta & Company. His focus is primarily strategic business planning, empowering clients to set priorities, focus energy and resources, and strengthen operations. In addition, Samy and his firm provide strategic counsel, and technical insight, on a wide range of needs, including tax saving strategies, tax return compliance, as well as choice of entity.