DBA or “doing business as” is one of those areas where terminology trips people up, so let’s start with the basics, because these two concepts get mixed together all the time.

A DBA is just a nickname. It’s a “doing business as” name that lets you operate under a different name than your legal entity. Registering your business in another state, on the other hand, is about permission. It’s that state formally saying your company is allowed to operate there.

Those two things are not interchangeable.

If you’re thinking you can avoid registering your company in a new state by simply filing a DBA there, that’s not how it works. A DBA doesn’t change where your business is legally operating, and it doesn’t replace the requirement to register when you’ve crossed the line into doing business in another state.

I see this mistake constantly with growing B2B businesses, especially California-based companies expanding quickly. It’s an easy assumption to make, and unfortunately one that usually shows up later as a compliance notice rather than a proactive planning conversation.

Simple Definition: DBA, State Registration, and Local Business License

First, let’s get the simple definitions out of the way. This stuff only gets confusing when people mix concepts that really belong in different buckets. Once you separate them, most of the headaches disappear.

1) DBA (Doing Business As)

A DBA is you telling the public, “My business in California is legally called this, but I operate under that name.” That’s all it is. It’s about branding and naming, not legal structure, compliance, or taxes. Filing a DBA doesn’t change where your company exists or what rules apply to it.

2) Registering your company in another state

This is you telling a state, “My company already exists in California, and now I’m doing business here too.” States usually call this foreign registration or foreign qualification. The word “foreign” throws people off, but it just means your company was formed somewhere else, not that it’s international.

3) Local business licenses (city or county)

This is your city or county saying, “If you’re operating here in San Francisco, we want you in our system—and yes, there’s usually a fee.” This is separate from state registration. You can be properly registered with the state and still be out of compliance locally because you missed a city or county license. Different office, different requirement.

Side-by-Side comparison: DBA vs. State Registration vs. Local License

| Item | What it is | What it does NOT do | Typical use case |

| DBA (trade name) | Public-facing nickname for your business | Does not replace state registration, payroll, or taxes | Brand name on invoices/website; multiple brands under one entity |

| State registration (foreign qualification) | Permission to do business in a state where you weren’t formed | Does not give you a local city/county license by itself | You hire employees, open a location, own property, or run ongoing work in that state |

| Local business license | City/county permission + fee to operate locally | Does not register your entity with the state | Office location, job site activity, local sales operations |

The Reason They Get Mixed Up

Honestly, it’s because the language is confusing. We use the phrase “doing business” casually, so it’s easy to assume that “Doing Business As” must be related. It sounds logical on the surface, even though the legal meaning is completely different.

A DBA is about names. It tells the public what name you’re operating under.

Registration is about permission. It’s the state saying your company is officially allowed to operate there.

Licenses are usually a city or local issue, and they deal with whether you’re allowed to conduct specific activities in a specific place.

When you keep those three buckets separate—names, permission, and licenses—you avoid most of the compliance problems I see. Not all of them, but easily 80% of the mess comes from mixing those concepts together.

Common Myths About DBA (aka “Doing Business As”)

Working with California-businesses for years and I still hear these few myths come up over and over again when they start operating across state lines. Let’s clear them up.

Myth: “If I file a DBA, the state can’t force me to register.”

Reality: One common assumption is that filing a DBA somehow prevents the state from requiring registration. It doesn’t. A DBA doesn’t change what your company is actually doing in the state—it’s simply a public name filing.

Myth: “We’re a Delaware company, so we’re basically exempt everywhere else.”

Reality: This idea that forming in Delaware makes you exempt everywhere else is a misconception. Delaware is just where your company was formed. It doesn’t give you a free pass to operate in other states without registering.

Myth: “We only have remote people, so we don’t have a presence.”

Reality: Remote employees absolutely count as a presence. The moment you’re running payroll in a state, you’ve created a footprint, and it happens faster than most people expect.

Myth: “We use contractors, not employees, so we’re safe.”

Reality: Some companies assume contractors are safer than employees. They’re not a guaranteed workaround. Contractors can still create ongoing business activity in a state, especially when they’re representing your business on the ground or working with customers.

Myth: “We’ll wait until we get big.”

Reality: States don’t wait for you to be big. They wait for you to be obvious—and by the time it’s obvious, the paperwork usually comes with penalties attached.

When do you actually need to register in another state?

Every state has its own definition of what counts as “doing business,” but in practice the triggers are pretty consistent. If any of the following are true, it’s something you should take seriously—not brush off or assume will fix itself later.

- Having an employee working in the state including remote employees working from their home address.

- Physical location whether that’s an office, warehouse, retail space, coworking office, or any other fixed place of business.

- Ongoing projects including one quick, one-off job is usually different from repeated or long-term activity.

- Real sales activity especially if you have people on the ground or a clear pattern of transactions tied to that state.

- Owning property in the state particularly in real estate. The same goes for inventory stored there, which comes up a lot with e-commerce businesses and third-party fulfillment centers.

The simplest way to think about it is this: if your operations touch a state in a meaningful way, that state expects paperwork.

It’s not the fun or flashy part of building a business, but it is the grown-up part—and skipping it usually creates more work later, not less

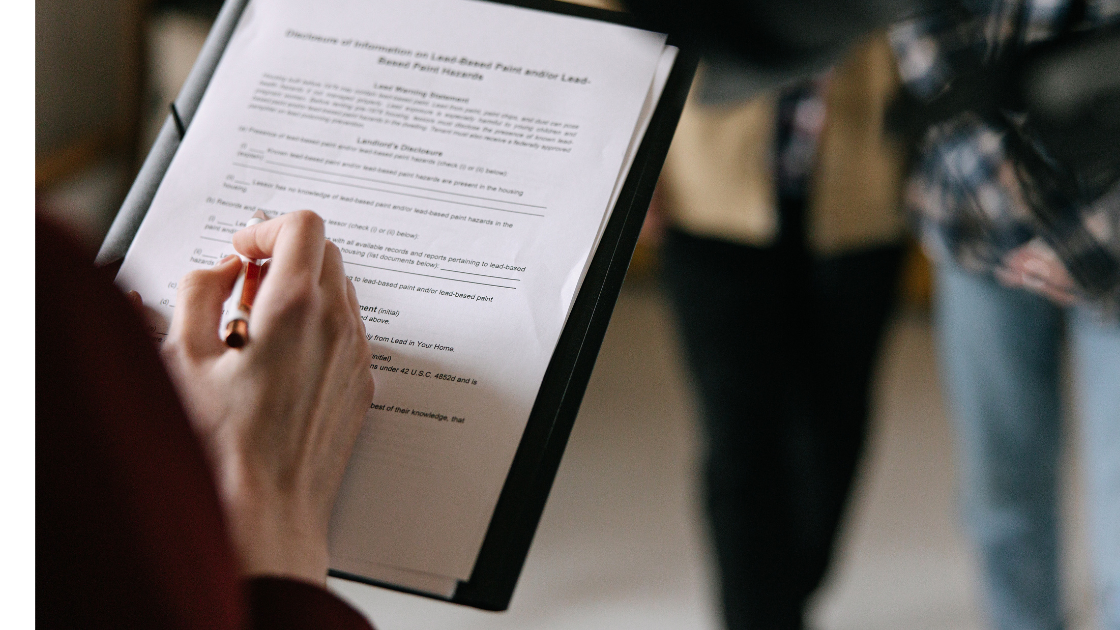

Is DBA enough? Having remote employees in another state is a trigger for state registration.

The ‘one-time job’ vs ‘ongoing presence’ line

One question that comes up all the time is where the line is between a “one-time job” and an ongoing presence.

On paper, a project can start out as one-and-done. In real life, that same project can quietly turn into six months of work, multiple crews, repeat bids, and maybe even a storage yard or local account before anyone stops to reassess.

When you’re trying to decide which side of the line you’re on, it helps to ask a few practical questions:

- We’re based in Miami with projects in San Francisco. How long will we be physically in the state? Days? Weeks? Months?

- Do we have people repeatedly traveling in San Francisco, or stationed there?

- Is this revenue likely to repeat next quarter?

- Are we pulling permits, opening accounts, leasing a San Francisco space, or signing local contracts?

The more often the answer is “yes,” the harder it is to defend the idea that this is just a one-time job. At some point, the facts matter more than the label you put on it.

What does registering in another state usually look like?

I’ll keep this high level, because the details vary by state, but the overall process is pretty similar everywhere.

- Get a Certificate of Good Standing (or similar) from your home state.

- Pick a registered agent in the new state (a real address for official mail).

- File an application to register/qualify your entity in that state.

- Pay fees, then keep up with annual reports and renewals.

- Set up state payroll tax accounts if you have employees there.

- Track state income/franchise tax filing requirements going forward.

What you’ll notice is what’s not on that list. There’s no step where you file a DBA and call it done.

DBA vs. State Registrations: Real-Life Scenarios

What this looks like in real life depends a lot on the industry. The rules are the same, but the triggers show up in different ways.

Construction (contractors, subs, trades)

This comes up constantly in construction. Maybe you’re formed in Arizona, but you start taking recurring jobs in California. You put a superintendent or project manager on the ground there. You lease a yard, a storage container, or an office trailer. You’re bidding public work or pulling permits under your company’s name.

A common scenario I see: a general contractor does “one” build in California. The client refers them to two more projects. Suddenly there are crews, a storage unit, and multiple cities asking for local licenses. If the company registers early, it’s straightforward. If they wait, it turns into paperwork plus panic.

SaaS and tech (remote teams, distributed hiring)

In tech, this usually starts with hiring. You’re a Delaware C-Corp and your first engineer lives in California. Then you add a sales rep in Texas who’s doing demos in person. Later, you hire a customer success manager in Florida to cover the East Coast. At some point, you run payroll in a new state and think, “Wait… do we need to do something?”

A typical mini-case: a SaaS startup hires one remote employee in California. Six months later, they’re onboarding a second person and a payroll notice shows up. The fix is simple—register, set up the accounts, and move on. The mistake is pretending the notice won’t arrive.

Real estate (investors, property managers, holding companies)

Real estate creates nexus quickly and obviously. You might own a rental property in another state under an LLC formed elsewhere. You’re collecting rent, signing leases, and managing repairs there. You may have a local agent or property manager acting on your behalf, and you’re opening bank accounts or signing contracts tied to that property.

A common example: a holding LLC formed in Wyoming buys a rental in California. That property alone creates a clear connection. Land records are public. The state doesn’t need you to announce yourself—they already know.

B2B services (agencies, consultants, engineering, professional firms)

For service businesses, it’s usually about time and presence. You take on a long-term client project in another state that lasts months, not days. You place employees or contractors on-site. You open a small satellite office in California to support a key client. You sign recurring service agreements and maintain an ongoing presence.

One example I see often: an engineering firm accepts a nine-month engagement out of state and sends staff on-site every week. That’s no longer “just a client.” That’s operations. At that point, registering isn’t optional—it’s how you keep your contracts clean and enforceable.

What is a DBA actually good for?

A DBA is a practical tool, not a loophole. When it’s used the right way, it solves very specific, very normal business problems—mostly around how your business presents itself to the outside world. If you think of a DBA as a branding and administrative tool, it starts to make a lot more sense.

DBAs are commonly used for things like:

- Branding, so your invoices, website, and marketing all match the name customers recognize

- Running a second brand under the same legal entity, with one back office and multiple storefront names

- Banking and contracts under a trade name, since some banks and clients want the DBA on file

- Cleaning up “my LLC name is ugly” situations without forming a brand-new entity

What a DBA is not good for is where people usually get into trouble.

What a DBA is NOT for

A DBA doesn’t change how the law sees your business. It doesn’t move activity out of a state, reduce compliance, or create legal separation. If you’re trying to use a DBA to avoid obligations, you’re using the wrong tool.

A DBA does not help with:

- Avoiding state registration (foreign qualification)

- Avoiding tax filing requirements

- Avoiding payroll rules, workers’ comp, or unemployment insurance

- Avoiding contractor licensing rules or permits

- Creating a separate liability shield, since a DBA has no separate legal existence

If what you actually need is a separate liability bucket, that’s a separate entity conversation—not a DBA conversation.

What Happens if you Ignore State Registration?

This is the part nobody enjoys talking about, but it’s worth being honest about it. States don’t just shrug and move on when a business is operating without registering. They send notices, and those notices tend to escalate quickly. They’re not written to be friendly, and they’re rarely a one-and-done situation.

- Once a state flags you, you’re usually looking at back filings to catch everything up. That often comes with interest on anything owed, plus late fees layered on top.

- In some states, there’s also a more practical problem: you may have trouble enforcing contracts until you’re properly registered, which is not where you want to be if you ever need to sue to get paid.

There can be downstream issues too. Banks and lenders don’t love it when your legal paperwork doesn’t line up with where you’re actually operating, and that friction tends to show up at the worst possible time.

If you ever sell the business or bring in an investor, compliance gaps almost always surface during due diligence—and buyers hate surprises like that.

The part people underestimate most is the distraction. Instead of planning calmly and fixing things on your own timeline, you end up reacting to deadlines, notices, and penalties under pressure.

And just to be clear, using a DBA doesn’t make any of this disappear. A DBA is paperwork about a name. The state’s concern is your activity.

Already operating in another state and not registered?

If you’re already operating California and then in another state but you’re not registered, don’t spiral. This is fixable, and it’s something I see all the time.

The clean way to handle it starts with getting out of guesswork mode. Do the following:

- Map out where your business actually has a footprint—people, projects, property, and real sales activity. Once you can see it clearly, register or qualify in the states where that footprint is obvious.

- Payroll is usually the urgent piece, so get those state payroll accounts set up correctly as soon as possible. From there, work with your CPA or legal team to handle any back filings that are required. If the dollar amounts are material, this is not a DIY project—you want it done cleanly and defensibly.

- Finally, put a simple compliance calendar in place so this doesn’t turn into a repeat problem next year. A little structure goes a long way.

The honest truth is this: ignoring it is almost always the most expensive option. Fixing it deliberately is cheaper, calmer, and far less disruptive in the long run.

A simple three-step checklist

Step 1. List every state where you have people, projects, property, or real sales activity. Don’t overthink this part. Just write the states down. Your payroll report, CRM, project list, and bank statements usually tell the story pretty quickly.

Step 2. Go state by state and ask a simple question: are we actually doing business here?

- If you have employees in a state, that’s usually a clear yes—or a very near-term yes.

- If you own property there, it’s almost always a yes. Ongoing projects are usually a yes too.

- And if you find yourself stuck in “maybe” territory, it’s better to plan for yes. That’s the CFO mindset: assume the conservative answer and avoid surprises.

Step 3. Finally, keep the buckets separate. This is where a lot of confusion disappears.

- Name-related issues live in the DBA bucket.

- Permission to operate in a state lives in the registration, or foreign qualification, bucket

- And city-specific requirements live in the local business license bucket.

When you keep those three concepts separate, the compliance picture gets a lot clearer—and a lot less stressful.

Avoid the DBA trap by establishing a system

The easiest way to stay ahead of this is to make it part of your operating system. Businesses used to expand one city at a time. Maybe your head office is in San Francisco, but you hired in three states in a single week without really thinking about it. That shift means you need a new habit.

Once a quarter, ask one simple question: did we create a new state footprint?

Build that question into your quarterly close, and then sanity-check a few specific things:

- Look at new hires by state, including both W-2 employees and long-term contractors.

- Pay attention to new customer locations that require on-site work.

- Review any new property, leases, or storage arrangements.

- Check whether inventory or fulfillment moved into a new state.

- If any state notices showed up in the mail, don’t ignore them.

When you do this consistently, issues surface early—before they turn into penalties, rushed filings, or late-night stress. It’s not glamorous, but it’s one of those habits that quietly saves you time, money, and sleep.

FAQs

“We’re an online business. Do states still care?”

Yes. States care about presence, not vibes. Remote employees and payroll are the big trigger for digital companies.

“What if we only have a few sales in a state?”

A few random sales usually isn’t the same as an ongoing presence. But once you have people, property, or consistent activity, the conversation changes fast.

“If I register in another state, do I need a DBA too?”

Not automatically. You need a DBA only if you’re using a trade name that’s different from your legal entity name in that state.

“We formed in Delaware. Are we supposed to register everywhere we have customers?”

Usually no. Customers alone are not the same as a physical or operational presence. The common triggers are employees, locations, ongoing projects, and property.

“Can I just form a new LLC in the new state instead?”

Sometimes that’s the right move. Sometimes it’s a mess. If you do it, do it intentionally and coordinate taxes, banking, contracts, and liability. Don’t do it as a panic move.

“Is a DBA the same as a trademark?”

No. A DBA is a filing that says you’re using a name. A trademark is intellectual property protection. Different tool, different purpose.

Bottom Line

Don’t try to DBA your way out of reality. A DBA is just a nickname. Registering in another state is about permission. When you treat those as two different tools—and use each one for what it’s actually meant to do—the compliance side of growth gets a lot simpler.

If you’re unsure where the line is for your business—or you suspect you’ve already crossed it—this is one of those things that’s much easier to talk through than guess at. A short conversation can usually clarify where registration is required, what’s urgent, and what can wait. If you want help sorting it out, you can schedule a call with me and we’ll walk through it together.

This is the kind of work I do as a fractional CFO. I help growing businesses connect day-to-day operations with the tax and compliance decisions that follow—so you’re not reacting to notices or making structure changes in a panic.

The goal is to handle this stuff calmly, intentionally, and in a way that actually supports growth instead of slowing it down.